Volume. 7 Issue. 37 – October 11, 2023

This week the Tribunal considers the appropriate handling of CERB in establishing IRB quantum. For the first time, consideration is given as to whether CERB is to be included in establishing the IRB quantum base amount prior to deductions, if any.

LAT Update – What Difference Did A Year Make?

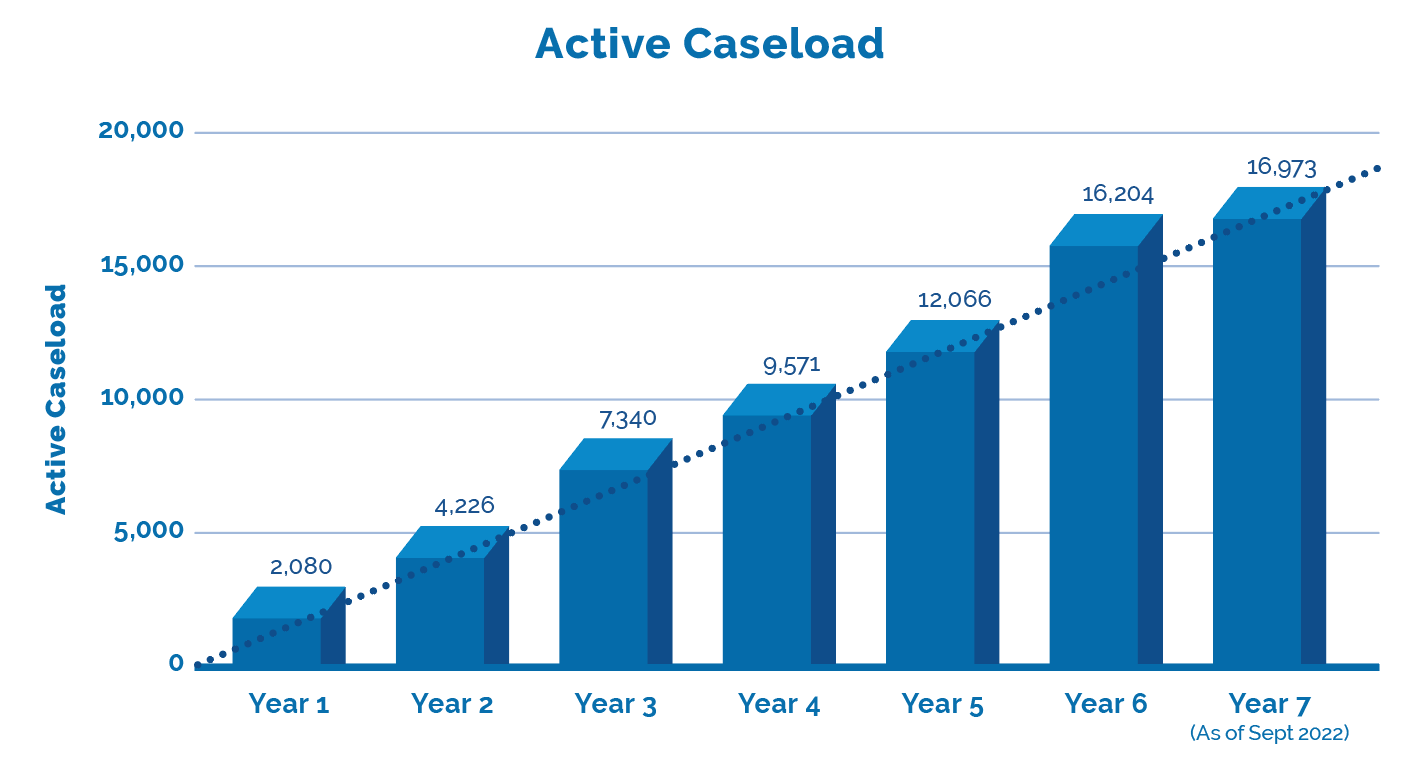

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

CERB Included in IRB Quantum Calculation

CERB is “Income” – Injured in a July 2020 accident, the Applicant Coto, in 21-006930 v Intact, disagreed as to the appropriate quantum of her ongoing entitlement to Income Replacement Benefits (IRB). Specifically at issue was the implications of Coto having received Canada Emergency Response Benefit (CERB), which appears to have been received both prior and subsequent to the accident in question.

Coto took the position that Intact erroneously failed to include the CERB received prior to the accident in their IRB calculation. She contended that the IRB quantum should be calculated based on the 52 weeks prior to the accident, including the CERB payments, as it was the income earned when she was unable to work during COVID. In addition, she contended that CERB received post accident is not deductible. Intact for their part submitted that Coto’s gross annual income is based entirely on self-employment and does not include the CERB payments, as it did not consider the CERB payments to meet the definition of “income” under s. 4(3).

It should be noted that the Tribunal has previously confirmed that CERB is not “gross employment income” and accordingly is not deductible from IRB being received. However, this appears at least to be the first instance in which there is consideration as to whether CERB received prior to the accident is to be included in IRB quantum calculation.

In the case at hand, the Tribunal noted that “CERB is not calculated with reference to income from employment. As CERB eligibility is not tied to employment status, it cannot be considered “gross employment income” under s. 4(1) because it is not analogous to “salary, wages and other remuneration from employment”.

Therefore, the Tribunal reaffirmed the precedent that CERB is not deductible from IRB. However, the Tribunal also ruled that the accountant’s report secured by Coto was preferred to that commissioned by Intact, as the latter “did not properly include the CERB payments, when it relied on its October 17, 2022 accounting report”. As such, the quantum established by Coto’s expert was preferred, and IRB was confirmed as $268.51 per week.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!