Volume. 7 Issue. 31 – August 23, 2023

This week, the Tribunal considered whether an Applicant involved in a WSIB facilitated Work Transition Program (WTP) on the date of loss would qualify for IRB following an accident. In the case at hand, the Applicant was rendered CAT as a result of the MVA and was unable to continue the WTP.

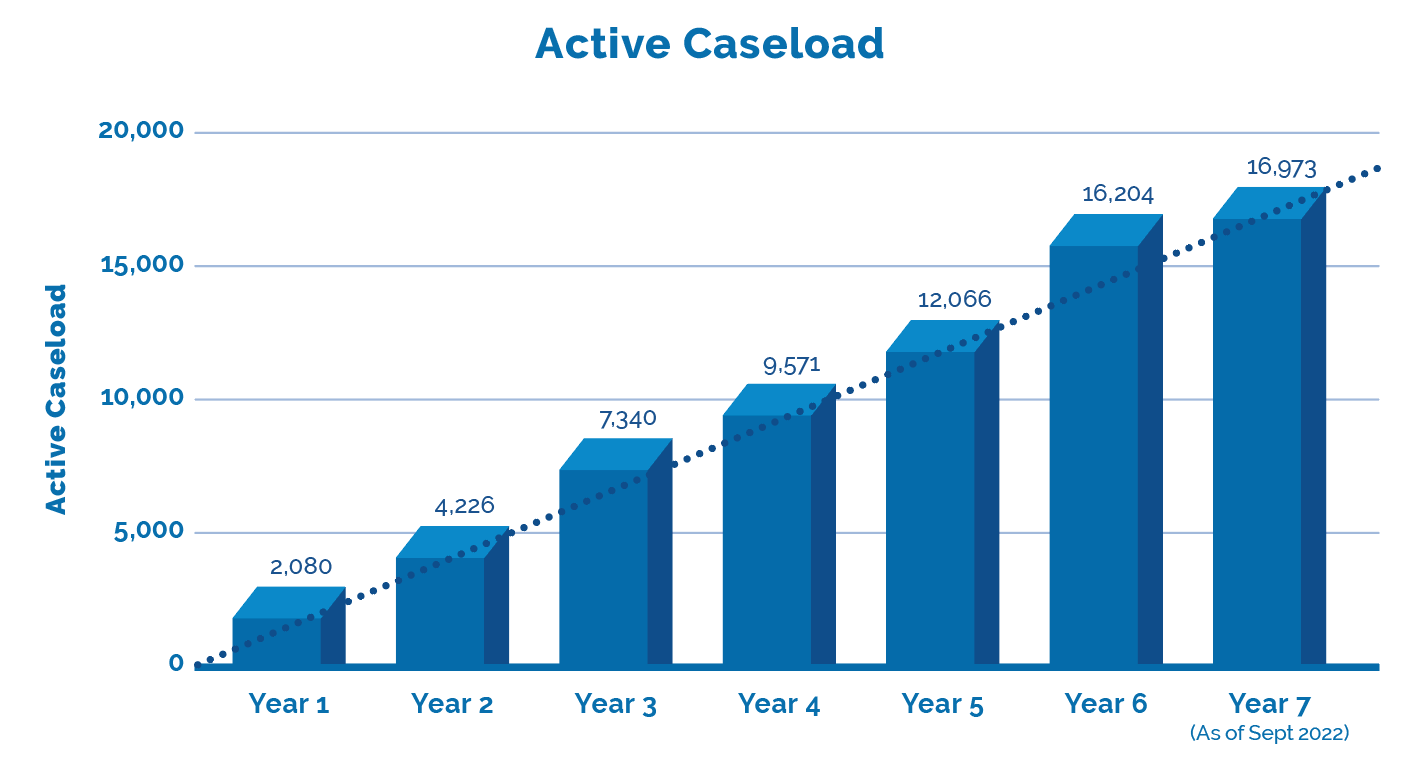

LAT Update – What Difference Did A Year Make?

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

WSIB Placement Qualifies for IRB

Work Placement Constitutes “Employment” – At the time of the October 2018 accident, the applicant Coban was in a work placement as part of a Work Transition Program (WTP) facilitated by the WSIB. Coban, in 21-012430 v Allstate, rendered CAT as a result of injuries sustained in the accident, sought entitlement to Income Replacement Benefits (IRB). He had been working 37.5 hours per week through to August 31, 2018, earning $651.61 weekly. Thereafter, his hours reduced to 8 per week, while he continued his 3rd year studies in the Architectural Technology program. Following the accident, as Coban was unable to continue working, the WTP was discontinued, and weekly benefits ceased November 5, 2018. However, Allstate took the position that Coban “was not “employed” due to the fact that his placement was part of a vocational rehabilitation program arranged through WSIB and he was in receipt of disability benefits rather than “employment income” during the relevant pre-accident interval.”

Coban relied upon the Divisional Court in Kawa Arab v. Unica Insurance, wherein it was concluded “that to be employed under the SABS for the purposes of determining IRB entitlement requires that an insured be (a) in an employment relationship, and (b) entitled to receive remuneration therefrom.” In addition, a prior case of the Tribunal, T. M. v Aviva General Insurance, that indicated “the Schedule uses the term “employed” in two senses. One is in the sense of being in an employment relationship. The second adds a need to be remunerated as remuneration is the basis for calculating entitlement. The current, applicable Schedule is silent on what constitutes a person being employed, thereby leaving the meaning open to interpretation. I find this broad wording should be interpreted in favour of the insured as intended by the consumer protection legislation mandate of the Schedule.”

Allstate countered that Coban’s WSIB benefits were “not contingent in any way upon the number of hours worked for COLE (the placement employer) during a particular interval. Further, payments received were contingent on his co-operation with all aspects of a labour market re-entry assessment or plan, and not upon the performance of any particular number of hours or duties for the applicant.” Further that “WSIB, not COLE had final say over what duties the applicant was to be performing as part of his work placement. The respondent states that it is the WSIB that demands that the applicant is to apply his architectural technician training and related skills to the job he is placed at. That is, WSIB, not the employer, is in control of the applicant’s duties.”

The Tribunal though was “persuaded that the applicant had an employee/employer relationship with COLE. While the WSIB had the pre-condition that the applicant was required to work where he could apply his architectural technician training and related skills, the employer defined the role and job duties. The purpose of the job search was to find an employer that could provide the position that suited the applicant’s training.” This was further confirmed by the fact that Coban was required to perform the duties of the role of Project Administrator as stated in the Memo from the RTW as to the job description provided by COLE, as well as report to his supervisor at COLE who worked with WSIB to ensure Coban was performing the duties of his placement.

As a result, the Tribunal concluded that Coban “was employed at the time of the accident, and that the responsibilities he was required to perform created an employee/employer relationship… he was required to perform the duties of the job that he was hired to do. The stipulation by the WSIB that the job utilize the skills he is in training for with regards to his education is only reasonable and doesn’t preclude the employer from managing the applicant like any other employee.”

Concluding, Coban “received remuneration from WSIB and I am persuaded that this remuneration was for employment. The Schedule provides the interpreter with the ability to be just and reasonable, and it is reasonable to connect the remuneration from WSIB directly to the employment with COLE. I find that the applicant is entitled to Income Replacement Benefits (IRB).”

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!