Tuesday Tips

2025

Did You Know?

Tuesday Tips are based on research questions from our community of LAT Compendium subscribers. You are not alone! Finding the right case doesn’t have to be a challenge. Let inHEALTH’s Live Chat experts help you find what you need.

June Tips

What 14% of MIG-Chronic Pain Cases Get Right

Q: What factors does the LAT favour when granting a MIG removal based on “chronic pain?”

Spotting Trends in MIG-Chronic Pain Decisions

In yesterday’s MIG Monday Stats Edition we reported that success rates for MIG decisions are around 18%. When chronic pain is part of the claim, that number drops to roughly 14%.

Some of the common threads in these cases:

-

Supporting evidence from treating physicians and treatment providers is often missing or not clearly acknowledged;

-

Submissions and expert reports sometimes don’t fully address the applicable test—particularly when it comes to showing how chronic pain affects function.

To explore what tends to work, try using our “Favour of Decision: For Applicant” filter. It highlights decisions where claims were successful, so you can see what arguments and evidence have resonated with the LAT.

inHEALTH’s industry leading indexing and filters get you to the cases that matter.

Tip: Want to know what wins? Filter for “For Applicant” and study the successes.

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced Search

2. Primary Criteria “Issues”: MIG-Chronic Pain

3. Secondary Criteria “Favour of Decision”: For Applicant

Results: 63 decisions on inHEALTH’s LAT Compendium

23-006927 v Wawanesa: The Applicant was removed from the MIG, as the CNRs of family physician Dr. Tong indicated that she regularly complained of ongoing complaints of pain in her foot, ankle, shin, leg and back. She further complained of functional limitations due to the pain, limited range of motion, inability to stand for long periods, and pain in her back, preventing her from sleeping. This resulted in her being placed on modified work by her employer.

22-003147 v Allstate: The Applicant was removed from the MIG and entitled to the disputed Treatment Plans totalling $6327.09 because she proved that she suffered from chronic pain and psychological impairments as a result of the accident. The Tribunal gave no weight to the IE reports of orthopedic surgeon Dr. Saplys and psychologist Dr. Saunders dated June 2021 because they did not review the CNRs of the Applicant’s family doctor Dr. Mang or of psychologist Dr. Langis, which demonstrated that she suffered from chronic pain, psychological impairments, and exacerbated pre-existing osteoarthritis. Further, the Tribunal agreed with the findings of psychologist Dr. Langis, and found that psychological Treatment and Assessment, as proposed in the disputed Plans, were reasonable and necessary.

Skip the "Quotation Marks" in Your Searches

Q: Can I use quotation marks in my keyword search?

We’ve noticed that many subscribers include quotation marks in their keyword searches. While that might work in other search engines, it can actually limit your results here.

That’s because inHEALTH’s LAT Compendium’s search works more like your browser’s “Find” function (Ctrl+F) it looks for the exact characters you type. So if you include quotation marks, the search will look for those marks too, which may prevent relevant results from showing up.

Just type the keyword or phrase without quotation marks for the best results.

📌 Example:

Searching for rulings related to adjuster log notes?

Just type: adjuster log notes

✔ No need for quotation marks

✔ Results include that exact phrase

✔ Faster, more focused search

Once your results are in, refine your search using our robust filter tools to find exactly what you need.

Tip: The search isn’t case sensitive, so no need to worry about capitalization.

Login to inHEALTH’s LAT Compendium:

1. Perform a keyword search WITHOUT quotations

Tuesday Tips Archive

Assessing the Assessor!

Q. I am considering a particular assessor and would like to see if they have ever been before the LAT and their results?

-

Keyword search: Search the names of all treatment clinics, treatment providers, physicians and other experts.

-

To find their results, you can filter in two ways:

-

Favour of Decision: This will indicate the overall outcome in favor of the Applicant, Respondent or Split.

-

Reason Code: Applicant’s/Respondent’s Assessor Preferred

-

You can find a complete list of our reason codes here, Reason Codes.

Tip: For best results start your initial keyword search with just the assessor’s last name.

1. Log onto inHEALTH’s LAT Compendium Service

2. Go to Keyword Search

3. Enter the name of the assessor

4. Filters – go to the left side navigation bar to see ‘Favour of Decision’

5. Filter again for Reason Code: Select either Applicant’s/Respondents Assessor Preferred or Credibility of Assessor

Need more? – Get a Research Report!

-

Assessor Performance: Get a clear, data-driven evaluation of an assessors’ effectiveness.

-

Select the Best Assessors: Make informed decisions when choosing assessors based on experience before the LAT and proven success.

Reach out today to get started!

Award Worthy Delays in Revisiting MIG Denials

Q. The insurer initially denied Treatment Plans on a MIG basis, later determining the MIG no longer applies. Are they obligated to revisit previous denials? Is this grounds for a Special Award?

Section 10 of Ontario Regulation 664 provides for the possibility of a “special award” where the insurer unreasonably withholds or delays payments. It reads:

10. If the Licence Appeal Tribunal finds that an insurer has unreasonably withheld or delayed payments, the Licence Appeal Tribunal, in addition to awarding the benefits and interest to which an insured person is entitled under the Statutory Accident Benefits Schedule, may award a lump sum of up to 50 per cent of the amount to which the person was entitled at the time of the award together with interest on all amounts then owing to the insured (including unpaid interest) at the rate of 2 per cent per month, compounded monthly, from the time the benefits first became payable under the Schedule.

Tip: Use “Keyword Search” to find decisions with key terms and then apply filters to narrow your results

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword search

2. Enter: revisit

3. Filter by “Issues”: Special Award

Results: 16 decisions on inHEALTH’s LAT Compendium

19-006241 v Dufferin Mutual: The Tribunal found that the Applicant is entitled to an award of $400, which is just under 5% of the delayed benefits. The Tribunal found there was an unreasonable delay in eventually conceding payment to the Applicant, which did not take place until the Case Conference. The Respondent had denied the s.25 physiatry and psychological assessments sought by the Applicant on the basis that they were a duplication of services of the Respondent’s s.44 assessments. This was not a valid medical or other basis for denial, and the Tribunal found that these denials clearly led to a delay in payment for the assessments, both of which were incurred by the Applicant. The Tribunal also found that the Respondent had an obligation to reconsider its earlier benefit denials once it made the determination to remove her from the MIG, but did not do so. However, the Tribunal also found that the Applicant’s adversarial approach and unreasonable attempts to control how the Respondent was conducting its assessments also contributed to the delay in payments.

19-001009 v Aviva: The Tribunal found that the Applicant is not entitled to an Award on the IRB as the denials did not meet all the standards for entitlement. However, she is entitled to an Award of 30% on the four disputed Treatment Plans that the Respondent ultimately agreed to fund. The Respondent’s initial denial was based on the MIG, however the Applicant should not have been in the MIG, based on the findings of the IE psychologist. As well, it was not reasonable for the Respondent to rely on that doctor’s conclusion that the Applicant should be in the MIG, or that she could be treated within the “MIG cap” since those are “legal or mixed psychological/legal conclusions” which are outside his expertise. The Tribunal also found a particularly unreasonable delay between the Respondent removing the Applicant from the MIG and ultimately approving the Treatment Plans.

20-009018 v Optimum: Adjudicator Pahuta found that the Respondent did not unreasonably withheld or delayed payments. At the time the Treatment Plans were denied, the Respondent determined, based on the IE assessments of Dr. Kerin and Dr. Liu, that the Applicant’s injuries were minor and subject to the limitations of the MIG. The partial approval of the earlier of the two Treatment Plans enabled the Applicant to obtain additional physiotherapy in preparation for her return to work. Adjudicator Pahuta found that once the Applicant was removed from the MIG, the Respondent should have reconsidered its denials of the Treatment Plans since they were denied on the MIG limits and not on their reasonableness or necessity. Adjudicator Pahuta found that while the Respondent’s failure to reconsider the Treatment Plans was incorrect, it did not rise to the threshold of bad faith conduct. No Special Award was in order because insurers cannot be held to a standard of perfection in their adjusting of claims.

20-007000 v Aviva: Adjudicator Kepman found the Treatment Plan was not payable on the basis of s. 38(8) of the Schedule, and s. 38(6) prevented the Respondent from reassessing the denied Treatment Plan after the Applicant was removed from the MIG. Adjudicator Kepman relied on the reasoning in 18-009606 v. Aviva.

Can One Mistake Take You Out of the MIG?

Your inHEALTH team has noticed that in several recent decisions, the Applicant argued that a s.38(8) notice violation allowed them to be removed from the MIG pursuant to s.38(11)1. The section reads:

“38(11) If the insurer fails to give a notice in accordance with subsection (8) in connection with a treatment and assessment plan, the following rules apply:

1. The insurer is prohibited from taking the position that the insured person has an impairment to which the Minor Injury Guideline applies.”

While one reading of the section could suggest that a notice violation takes the Applicant out of the MIG entirely, and some early Tribunal decisions interpreted it this way, the Divisional Court in Zheng and Cai v. Aviva held that s.38(11)1 only prohibits the insurer from applying the MIG to the Treatment Plan the violation relates to because the language used in s.38 refers to a specific Treatment Plan submission.

Tip: We have several “Non-Compliance” filters that you can use, including one for s.38(11) violations. You can also use our date filter to find recent decisions that have involved this issue.

Talk to your personal support team on Live Chat. We provide answers

- Go to Advanced Search

- Select Primary Criteria “Issues/Benefit in Dispute”: Non-Compliance S.38(11)

- Select Secondary Criteria “Issues/Benefit in Dispute”: MIG

- Filter by “Release Date”: 2022-12-10 to 2024-12-10

Results: 36 decisions on inHEALTH’s LAT Compendium

21-012748 v Aviva: Adjudicator Deol applied the 2018 Divisional Court Decision of Zheng Cai v. Aviva, where the language of s.38(11) operated to bar the Respondent from taking the MIG position in respect of the particular Treatment Plan and was not an absolute bar in relation to the entire Application. Adjudicator Deol found that the Applicant was entitled to any incurred costs between the time period starting on the 11th business day after the day the Respondent received the Treatment Plan and ending on October 19, 2021.

22-007295 v Belairdirect: The Applicant was found to be in the MIG because he produced no substantive submissions or evidence but relied solely on his argument that he should be removed pursuant to s.38(11) of the Schedule due to the Respondent’s breach of the notice requirements set out in s.38(8). However, the Tribunal found that Zheng and Cai v. Aviva held that s.38(11) only applied to the specific Treatment Plan in question and did not impose a permanent prohibition on the insurer applying the MIG.

22-008578 v Allstate: Adjudicator Levitsky applied the principles in the Divisional Court decision in Zheng, Cai v. Aviva , which found that s.38 referred to the specific Treatment Plan in question, and s.38(11) did not impose a permanent prohibition on an insurer with regard to a MIG determination. Adjudicator Levitsky found that an improper denial did not result in the Applicant being removed from the MIG entirely.

Challenging Opinions Where Records Not Reviewed

Q: The assessor did not review or reference the medical records that were provided to them in their opinion finding a treatment plan not reasonable and necessary. What search is optimal to find these cases?

Tip: Adding items from different filter categories functions as an “and” term and includes only hits containing all the items. However, adding multiple items within a category functions as an “or” term and includes each of those hits, even if not all together.

-

- Go to Keyword Search Enter – did not review

- Filter Results under Issues: Med

- Filter Results under Reason Code: Applicant’s Assessor Preferred

- Filter Results under Reason Code: Applicant’s Medical Records/CNRs

- Filter Results under Reason Code: Respondent’s Assessor Preferred

Results: 49 decisions on inHEALTH’s LAT Compendium

20-001512 v Unifund: In support of the physiotherapy Treatment Plan, the Applicant relied on the November 2019 report of Dr. Pathak, pain medicine specialist who recommended that the Applicant continue the various therapies. Adjudicator Kaur did not assign much weight to said report as he did not review any of the Applicant’s medical records. The Applicant reported that physical therapy alleviated his pain. However, this is different from what he had reported to Dr. Kopansky-Giles, chiropractor, a month prior at the IE. Moreover, the CNRs from Dr. Aziz months before the date of this Treatment Plan do not make any mention of pain-related complaints. The April 2019 report of Dr. WIlderman, chronic pain specialist, was also given little weight as Dr. Wilderman did not review the Applicant’s medical records. Accordingly, the Treatment Plan is not reasonable and necessary.

21-011242 v Aviva: Vice Chair Todd assigned Dr. Tu’s IE report little weight since she did not review any of the Applicant’s CNRs from treating physicians or the chronic pain assessment report, which was a significant omission. As such, the Applicant is entitled to the chronic pain assessment.

22-011557 v Security National: Adjudicator Mauro gave limited weight to Dr. Syed’s conclusion because, as argued by the Applicant, she did not review the progress report of social worker Ms. Mentz or previous OCF-18s. If she had reviewed them, Dr. Syed would have likely concluded that proceeding with social work treatment was necessary, as Ms. Mentz indicated that treatment enabled the Applicant’s ongoing progress and provided the required support to avoid client risk of re-injury, isolation, and deterioration of mental health and overall function. Moreover, the progress report of Ms. Mentz stated that the Applicant would learn strategies to manage stress, anxiety, and depressive symptomatology.

Credible Psych Reports

Q: Does not having psychological validity testing in an assessment affect the report’s credibility before the LAT when dealing with psychological impairments?

Tip: Find cases with issue-specific search filters to eliminate cumbersome keyword searches.

LAT Compendium Search

- Go to Issue/Benefit in Dispute

- Select Psych Validity Testing

Results: 124 decisions on inHEALTH’s LAT Compendium

16-000670 v Aviva: Adjudicator Truong preferred the medical evidence of the Respondent. Dr. Syed’s Psychological IE found no objective psychometric evidence of impairment and noted that the Applicant’s responses were “indicative of infrequent and atypical responding” as well as “feigning psychological impairment.” Little weight was given to the Applicant’s Psychological report by Dr. Pilowsky, as Dr. Pilowsky did not administer validity testing.

20-009840 v Travelers: Vice-Chair Brooks preferred the IE assessment by Psychologist Dr. A. Rubenstein, who concluded in December 2018 that the Applicant had no psychological impairments, and that the Applicant compromised the validity of psychological testing by amplifying her symptoms, because Dr. Rubenstein used clinical testing methods which enabled him to determine whether the Applicant was providing credible answers and Dr. Wagner did not administer validity testing.

Calling All Motions!

Q: I am filing a motion requesting surveillance evidence to be admitted after the production deadline. Can you provide me with cases in favour of my request?

Motions before the LAT are often combined with the hearing decision. However, stand-alone motions are often not published on CanLii and are generally only provided to the parties. They are not included in the LAT Compendium unless submitted to inHEALTH by one of the parties.

Tip: Provide inHEALTH with your motion decisions received by the LAT. inHEALTH will add a case summary and organize the relevant data into our database making important issues available and searchable. Share your motion results by submitting your decision to service@inhealth.ca.

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword search

2. Search: Surveillance

3. Filter by “Issues”: Evidence-Admissibility

4. Results: 57 decisions on inHEALTH’s LAT Compendium. (filtering by “Case Type: Motion” brings the results to 2. Your submitted motion decisions will allow us to increase this number.)*

*Stand-alone motions can be filtered by selecting “Case Type”: Motion.

|

19-012281 v Wawanesa: At the outset of the hearing, Adjudicator Paluch considered the Applicant’s request to exclude the Respondent’s surveillance report and social media searches as they were served two and a half months late. Finding said evidence to be relevant, the Adjudicator declined the request but allowed parties to file submissions on its weight at the conclusion of the hearing. 19-014590 v TTC: Adjudicator Lester agreed with the Applicant that the video and report give very little probative value and are not relevant to the issues in dispute. The video was not used to determine the benefits in dispute and was not given to any of the assessors for comment. The Respondent had the video and report for 3 years and it missed two ordered deadlines to produce it. The three cases relied on by the Respondent were found to be distinguishable as the video surveillance was considered relevant to the issues in dispute in those cases. In this case, the prejudice caused to the Applicant in preparing its witnesses and elongating the hearing outweighs any probative value and therefore it was excluded. 20-000829 v Aviva: The Tribunal found that the surveillance evidence obtained by the Respondent is not admissible due to late submission. The Tribunal found the Respondent did not take any steps to rectify its error and instead placed the onus on the Applicant to relieve the Respondent of its obligations to provide proper disclosure of evidence and provide her with the opportunity to deny, explain or adopt the evidence.

|

|

21-011865 v Security National: The Respondent submitted that the surveillance should not be excluded as it was served 10 days in advance of the hearing. Further, the surveillance was just obtained recently and was relevant to the Applicant’s function. Adjudicator Hines admitted the surveillance and advised that any relevance of the evidence would go to weight. 22-001330 v Co-operators: Addressing the procedural issue first, Adjudicator Adamidis accepted the Applicant’s request to exclude the surveillance report dated December 2021 because it was submitted past the deadline set by the CCRO and the Respondent provided no explanation for its non-compliance. |

Deductibility of Post-Accident EI Benefits

Q. Are Employment Insurance (EI) benefits received after the accident deductible from IRBs?

Navigating the SABS when calculating IRBs can be a bit tricky. Take for example the deductibility of EI benefits. While the definition of “gross employment income” in s. 4(1) includes benefits received under the Employment Insurance Act, they are specifically excluded from the definition of “other income replacement assistance” and the collateral benefits deduction section of 47(1)(3)(f). Some have argued that therefore post-accident EI benefits are not deductible from IRBs.

Our search below allows you to quickly solve this apparent discrepancy.

Tip: The LAT Compendium has many specific filters to help you with any IRB-Quantum issues dealt with by the Tribunal.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced search and enter: pre-screen

2. Under Primary Criteria Select: “Issues/Benefit in Dispute” and IRB-Quantum

3. Under Secondary Criteria Select: “Issues/Benefit in Dispute” and Deduction of Collateral Benefits – Employment Insurance

Results: 9 decisions on inHEALTH’s LAT Compendium

Aviva v Spence: The Tribunal’s three errors were in finding an ambiguity in the legislation where none existed; finding that only income from active employment qualifies as gross employment income; and finding that the EI sickness benefits paid qualified as temporary disability benefits. The Divisional Court found no conflict between the way in which EI benefits are deducted as gross employment income from IRBs under s. 7(3)(a) and the way in they are excluded from the definitions of other income replacement assistance under s. 4(1), and temporary disability benefits under s.47(3). Excluding EI benefits from these definitions ensures that EI benefits, which might otherwise meet the definitions, are not deducted twice.

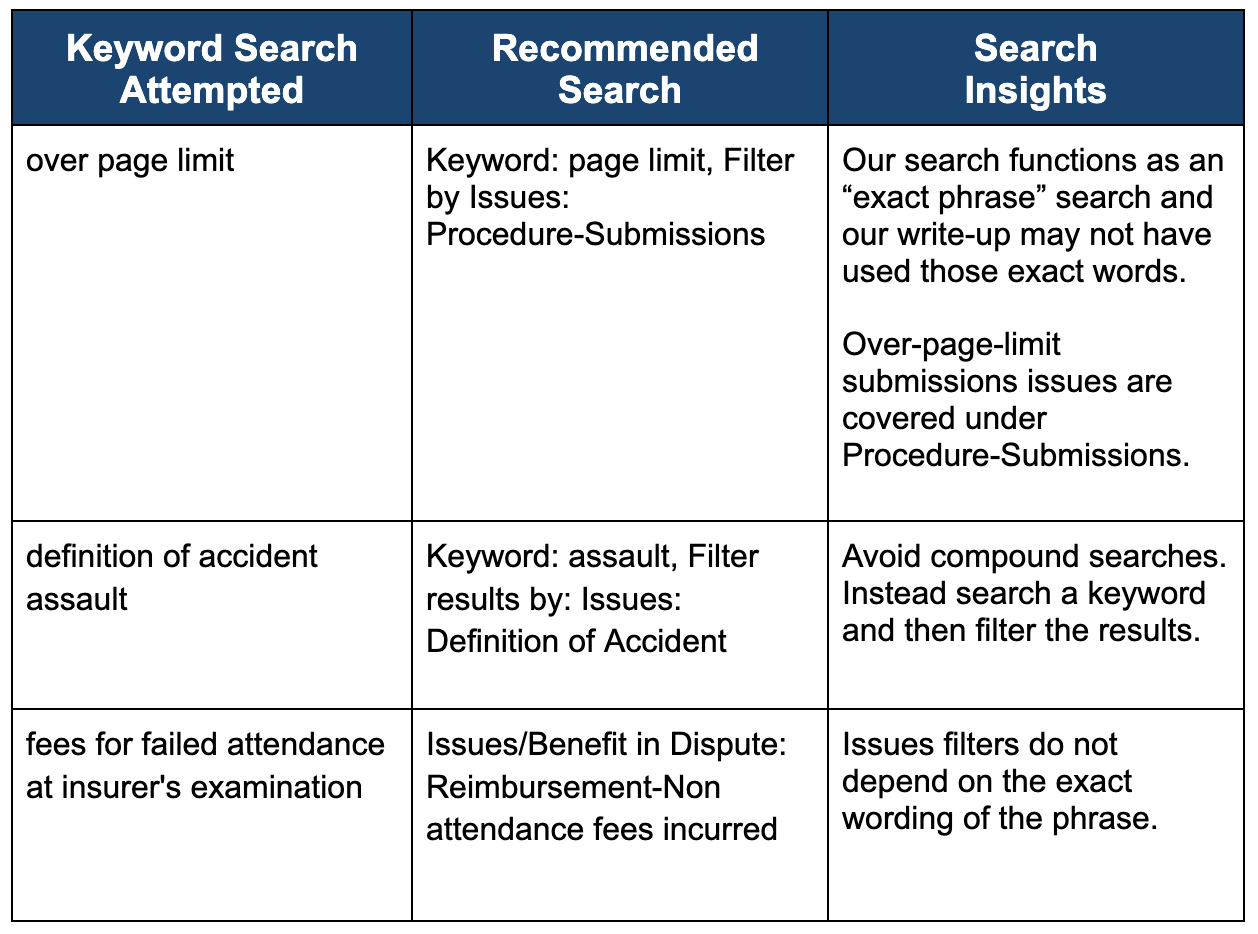

Deep Dive Into The Archive

Q. Help! I got 0 results returned using the keyword search!

To best answer this question, we took a deep dive into the archive vault of keyword searches to unlock common mistakes to avoid when using search terms.

The charm of inHEALTH’s industry-leading LAT Compendium is that our search filters are organized by issues commonly raised in disputed cases designed to help you navigate to the right decisions or the principles you need to analyze.

Tip: Combining keyword searches with filters is a powerful way to refine and supercharge your search results! Here’s how to do it:

Want to know if we have an applicable filter? There is no bad question – Your Personal Support Team is standing by to help using our Live Chat!

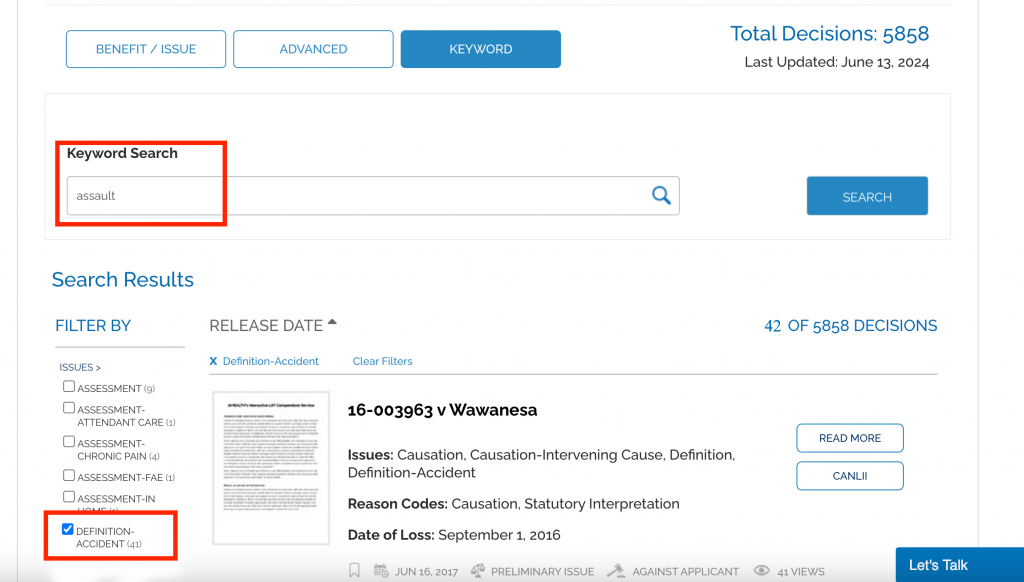

Definition Of Accident

Q: Can an assault involving a vehicle be considered an accident?

Tip: LAT Compendium Search

Keyword Search: Assault

Filter Results by ‘Issues’: Definition-Accident

Results: 41 decisions on inHEALTH’s LAT Compendium

Most Recent Decision: 23-013882 v Co-operators (July 18, 2024)

SABS Test: Facts must meet “Purpose” and “Causation” Tests

Don’t Use Quotation Marks

Q. I’m looking for some guidance on finding cases that say whether “maximum therapeutic benefit” was ever accepted as a reason to maintain the denial of physiotherapy treatment, etc. I tried searching “maximum therapeutic benefit” in the keyword search but nothing turned up.

The LAT Compendium’s keyword search functions as an “exact string” search, like a control find (Ctrl+F) so quotation marks are not needed. In fact, if you include them, the search will look for decisions that include the quotation marks around the phrase. *Please note that the search is not case sensitive.

Tip: Do not use quotation marks while using our keyword search.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword search and enter: pre-screen

2. Enter: maximum therapeutic benefit

Results: 22 decisions on inHEALTH’s LAT Compendium

23-000739 v Intact: The Applicant was not entitled to the physiotherapy Treatment Plans for $5,002.32 as she had not presented evidence to support that they were reasonable and necessary and Dr. Sandhu, in his March 2022 report, found she had likely achieved maximum therapeutic benefits from faculty-based treatment.

22-001161 v Aviva: Similarly, the Applicant was also entitled to the massage therapy and chiropractic treatment OCF-18 in the amount of $1,487.60. Although Dr. Rabinovitch concluded that the Applicant had reached maximum therapeutic benefit, Adjudicator Deol placed more weight on the opinion of her treating practitioner, Dr. Perelman. In November 2021, Dr. Perelman recommended massage therapy as part of the Applicant’s pain management program. In addition, the records of treating chiropractor, Dr. Runyon, noted in July 2020, that the Applicant had reported improvement with the treatment.

22-008162 v Industrial Alliance: The Tribunal preferred the September 2022 IE report of chiropractor Dr. Dimakis, as he found no clinical indication for any further treatment or rehabilitation services as the Applicant had reached maximum therapeutic benefit. In addition, the Applicant was unable to show improvement in symptoms despite attending treatment twice a week for eight years.

Do You Know What You Missed Last Week?

Q: I don’t want to miss important new LAT and court decisions, but I just don’t have the time to read them all. How can inHEALTH help me with this?

In the ever-evolving landscape of Accident Benefit disputes, with an average of 30 decisions released weekly by the LAT and courts, staying up to date with current case law and interpretation is crucial to all practicing professionals who want to maintain a competitive edge and deliver the best results.

inHEALTH’s LAT Compendium’s comprehensive/nuanced case summaries help you stay current as fast and effectively as possible.

Here are a few reasons why staying up to date is critical:

- Changes in Legal Precedent: Each decision can either reinforce or alter established principles, which may shift how claims are handled. Keeping up with rulings ensures that you are considering the most current interpretations and precedents.

- New Ideas to Bring to Your Files and Inform Strategy: Understanding how the LAT and the courts are interpreting the SABS ensures that you can make decisions that are aligned with current case law. Keeping up with decisions gives you new ideas to apply to your own files and helps in negotiating settlements, providing advice, and preparing for hearings.

- Adapting to Evolving Standards: The legal landscape often reflects broader societal changes, such as shifts in medical practices, insurance trends, or public policy. Accident Benefit decisions can adapt to these, influencing claim assessments, benefit eligibility, and compensation calculations.

Tip: Use inHEALTH’s LAT Compendium “Recently Added” tab to view all decisions published in the last 30 days (or set a custom date range).

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to the ‘RECENTLY ADDED’ Tab

2. Results: 100 decisions on inHEALTH’s LAT Compendium

3. Skim the “Issues” listed and decide which cases you want more details on

4. Click “Read more” to get a further layer of information and use the save/print feature for an added bonus!

23-015303 v Zenith Insurance: The Tribunal found the Applicant was involved in an accident on September 16, 2020, within the meaning of s.3(1). The Applicant’s injuries occurred when she fell while attempting to walk her dog around a parked truck that was overhanging the sidewalk. The Tribunal found that although her dog, the uneven sidewalk, or her sandal may have contributed to her subsequent injury, the use or operation of the pickup truck, parked so that its bumper was overhanging the sidewalk requiring her to attempt to navigate around it, was a direct cause of her injury. Navigating around the bumper of a parked truck is a normal incident of the risk involved in using the vehicle. The Applicant met both the purpose and causation test.

TD Insurance v 21-013393: The Applicant (the insurer) was entitled to seek repayment of medical and rehabilitation benefits paid due to the Respondent’s (the insured) material misrepresentations pursuant to s. 52 of the Schedule. The Tribunal rejected the Respondent’s argument that no repayment was owed for benefits paid directly to third-party service providers. It was persuaded by the Tribunal cases provided by the Respondent that found claimants were liable to repay medical and rehabilitation benefits, regardless of if the payments went directly to third-party service providers, because they were consistent with the intentions of s. 52. It found it would be illogical to consider that the intention of the legislature was to limit an insurer’s ability to claim repayment if the benefits were paid directly to third-party service providers.

22-004678 v Aviva: Adjudicator Levitsky applied the principles in the Divisional Court decision in Zheng, Cai v. Aviva , which found that s.38 referred to the specific Treatment Plan in question, and s.38(11) did not impose a permanent prohibition on an insurer with regard to a MIG determination. Adjudicator Levitsky found that an improper denial did not result in the Applicant being removed from the MIG entirely.

Get Only the Most Relevant Cited Cases

Q: How do I identify which decisions in my search results have been cited by other cases?

The key benefit of inHEALTH’s dedicated database, complete with nuanced case summaries written and curated by our experts, is that we don’t just list cases that are mentioned in passing. We only include cited cases when the decision genuinely turns on them or engages with them in a meaningful way.

When you get your search results, look for the decisions with grey superscripts following the name. This indicates the number of cases that have cited the decision. Clicking on it will open a separate tab populated with all of those cases.

Tip: Click on the grey superscript in the search results to see decisions citing that case.

How to Demonstrate “Marked” Impairment

CAT Determination – Useful Factors for Marked Impairment

Q: What factors should be considered when assessing marked impairments that “significantly impede useful function” under Criterion 8?

Tip: Use keyword searches to isolate key strings in searches.

LAT Compendium Search:

1. Go to the Keyword Search

2. Search significantly impede useful function

Results: 8 decisions on inHEALTH’s LAT Compendium

SABS Test:

22-001654 v Wawanesa: Moderate impairments are compatible with “some” useful functioning. Marked impairments significantly impede “all” useful functioning.

20-001934 v Unica: It is important to accurately capture the applicant’s pre- and post-accident functions based on the totality of the medical and documentary evidence provided to determine the level of impairments for each of the four domains and whether these impairments, “significantly impede useful functioning.”

18-000605 v State Farm: The Tribunal prefers more thorough Occupational Therapy (OT) reports.

21-007794 v Co-operators: The Applicant must show that it is their psychological impairment which significantly impedes useful functioning, not their physical impairment.

18-000605 v State Farm: Credibility is important. It is necessary to look at the consistency in the information from the applicant’s testimony and that of their family members.

Looking for more decisions on CAT? Find all our CAT filters under issue in dispute.

IE’s: To Go or Not To Go?

Q: I need to find cases on the risk of not attending the Insurer’s Examination when I believe the Notice of Examination doesn’t provide sufficient reasons? If the Applicant attends the IE and it is determined the notice was insufficient, can the report be relied upon?

A: inHEALTH assists the researcher to narrow the search parameters based on the rationale/reasons they seek to have the report struck from the record. We can look at this question in a few different ways to help the researcher specify their searches.

- We can note that this question is related to cases dealing with whether Applicants have a right to dispute pursuant to s.55(1)2 when they do not attend IEs.

- We can look at cases where the Applicant attended the IE but sought to void the results based on the non-compliant notice.

- We narrowed the search to 21-004696 v Aviva where the Tribunal found that the Applicant’s right to challenge the insufficiency of an NOE was not waived by his attendance at the IEs, and the Tribunal did not consider the IE report based on the non-compliant notice.

Tip: Talk to your personal support team on Live Chat. We provide answers

-

- Go to Advanced Search

- Select Primary Criteria: “Referenced Cases/Legislation”

- Select: 21-004696 v. Aviva Insurance Company (Tribunal File Number 21-004696/AABS)

Results: 7 decisions on inHEALTH’s LAT Compendium

23-000568 v Allstate: Adjudicator Mohammed agreed with the Tribunal in 21-004696 that when a notice was deficient, the resulting IE was improper and that the results should not be considered. He further found the September 2022 IE was improper and the results would be given no weight.

22-000648 v Aviva: Adjudicator Jarda found that neither 21-004696 nor its reconsideration stood for the proposition that if an applicant attended an examination despite a non-compliant notice that any reports obtained from the examination would be void.

22-001864 v Aviva: Adjudicator Levitsky found that accepting the Applicant’s reasoning would lead to an absurd result where insureds could make a tactical decision to attend assessments, and if the assessment was not favourable, argue that the Treatment Plan was payable based on a technicality. She did not agree with the Tribunal’s statements in M.B. and 21-005696 that the Schedule makes no provision for an insured to be able to waive requirements under the Schedule, and only allows an insurer to do so. S. 44(6) allows the parties to mutually agree to waive a requirement for notice, and s. 46(2) allows an insured person to waive a conflict of interest with respect to a referral.

Keep Track As You Research

Q: Can I save decisions that I find useful?

When you’re in the middle of reviewing one of inHEALTH’s search results and need to save the decision, use the “Save Decision” feature. This will bring you right back to inHEALTH’s summary display page, where you’ll find:

-

Associated Parties

-

Associated Issues and Reason Codes Identified

-

Case Summary (with a “Read More” option)

-

Direct Link to CanLII for full legal text

Tip: Use the Save Decision feature to seamlessly keep track of key decisions during your research without losing your place.

Login to inHEALTH’s LAT Compendium:

1. Perform a Search

2. Open the Read More on a decision you want to save

3. Click on the Save Decision button (to the left of the summary)

4. Your Saved Results will appear at the bottom of the search page

5. When you are done with a saved result, simply click delete.

Looking for a SABS Provision?

Q: What is the best way to search for SABS provisions?

Cut Through the Inconsistency and Find the Right LAT Decisions Faster

LAT decisions can be tricky. One case might refer to the SABS as “Section,” another as “section,” and yet another as just “s.” This inconsistency makes it tough to find the decisions that really matter.

That’s where inHEALTH steps in

Our Referenced Cases/Legislation filter cuts through the confusion. We carefully tag only the most relevant SABS provisions, those that the decision actually turns on, so you don’t waste time sifting through noise.

Start finding the right decisions faster—with clarity and confidence.

Tip: Use the Referenced Cases/Legislation drop-down in Advanced Search

1. Log onto inHEALTH’s LAT Compendium Service

2. Go to Advanced Search

3. Select Primary Criteria “Referenced Cases/Legislation”: SABS: S. 44(1)

→ Pro tip: Press “S” to jump straight to all the SABS provisions

4. Results: 135 decisions on inHEALTH’s LAT Compendium

5. Filter Results Further by “Issues”: Reasonably Necessary Test (S.44)

6. Results: 43 decisions on inHEALTH’s LAT Compendium

✅ Bonus: inHEALTH applies this precise tagging to all key legislative provisions across our database.

Need more? – Get a Research Report!

Reach out today to get started!

Medical Benefits ‘Payable’ Beyond 5 Years

Q. If I proceed to the LAT outside of the 5 year window on a non-CAT denial that was made within the 5 year window

1) Do I still have a right to dispute? and

2) If I am successful will the insurer pay my claim?

Duration of medical, rehabilitation and attendant care benefits

Generally, s. 20 prohibits payment of medical benefits incurred beyond 260 weeks for non-catastrophic cases. However, there may be exceptions.

20. (1) Subject to subsection (2), no medical, rehabilitation and attendant care benefit is payable for expenses incurred,

(a) more than 260 weeks after the accident, in the case of an insured person who was at least 18 years of age at the time of the accident; or

(b) after the insured person’s 28th birthday, in the case of an insured person who was under 18 years of age at the time of the accident. O. Reg. 251/15, s.10.

Tip: Search for decisions turning on specific sections of the SABS to quickly find the decisions you need.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced search

2. Select Primary Criteria: “Referenced Cases/Legislation” and SABS: S.20

Results: 23 decisions on inHEALTH’s LAT Compendium

21-014475 v Wawanesa: The Tribunal found that the Applicant can proceed to a hearing with her claim for a physiatry assessment, despite the assessment not having been incurred within 260 weeks after the accident. The Tribunal disagreed with the Respondent’s position that the definition of incurred expense in s.3(7)(e) of the Schedule, when combined with s.20, places an absolute bar on its liability to pay for prospective treatment that has not been provided within 260 weeks. If the Respondent’s position were to be accepted, it would relieve the Respondent of the obligation to pay for approved treatments that have not been fully consumed within the 260 weeks. The Tribunal opined, “the only way to resolve any apparent absurdities is to see a treatment approval as an undertaking to pay for the whole course of treatment even though it terminates beyond the 260 week period.” If the Treatment Plan is found to be reasonable and necessary, the issue is not when the Respondent will have to honour its obligations to fund treatment under the Schedule at some point in the future, but when it should have honoured its obligations in the past. Such an interpretation is in line with Aviva v. Suarez and the intent of the Schedule to ensure treatment is made available to those in need.

21-010688 v Aviva: Adjudicator Adamidis disagreed with the Respondent’s argument that pursuant to s.20, the Applicant is ineligible for any further benefits, since the accident was over six years ago, and he has not been found to be catastrophically impaired. The Treatment Plans were submitted to the Respondent well before the 260-week period expired. The Respondent denied the Plans and the Applicant applied to the Tribunal; therefore, the time limits in s. 20 do not apply

21-010260 v Economical: The Tribunal rejected the Respondent’s submission that there was no evidence the Plan was incurred within 260 weeks of her accident, in accordance with s.20(1)(a) of the Schedule, and found that to require an insured person to pay for treatment as a precursor to commencing an application to the Tribunal would disadvantage the impecunious as set out in Aviva v. Danay Suarez.

22-013616 v Aviva: Adjudicator Malach found that the Applicant was not barred from proceeding to a hearing for the four Treatment Plans for OT assessment, driving assessment, chronic pain assessment and physiotherapy, pursuant to s.20(1) of the Schedule. Adjudicator Malach found that requiring an insured to pre-pay for treatment before proceeding to the Tribunal would disadvantage the impecunious as per Aviva v. Danay Suarez. He had five years from the date of the accident to seek treatment. The treatment was denied, so he had two years to appeal to the Tribunal. His right to payment of the disputed OCF-18s did not expire with the lapse of the 260 weeks.

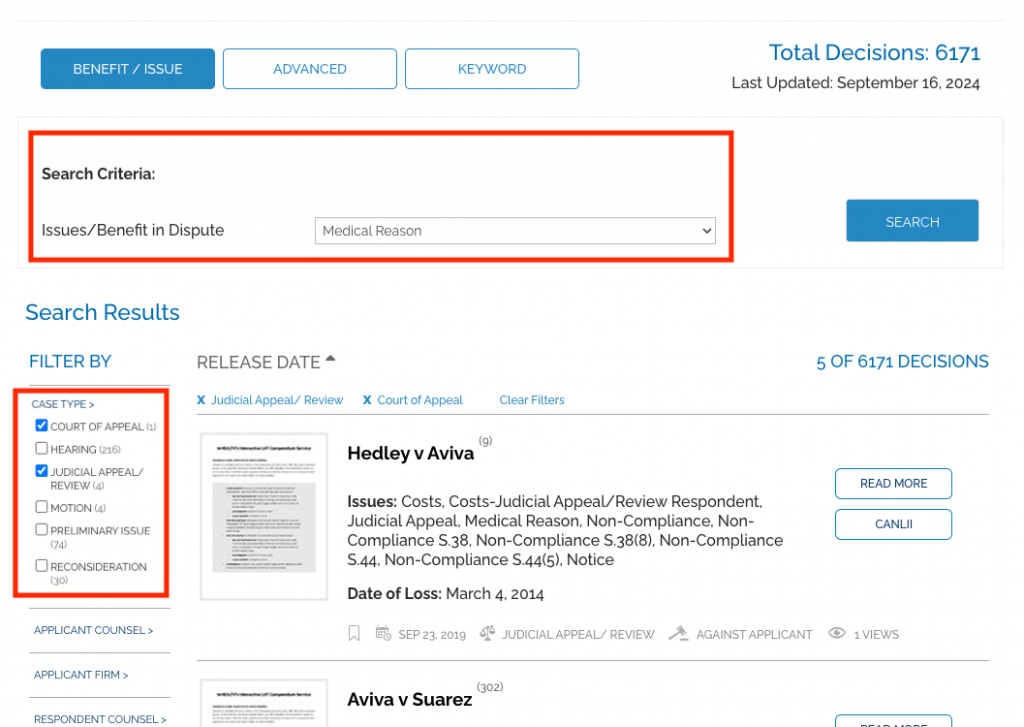

Medical Reasons

‘Mere Boilerplate’ Statements Are No Reasons At All

Sufficient “medical and any other reasons” have emerged as a significant part of handling accident benefit cases. The success rate when this issue is raised is 50/50, a key indicator of its importance to both parties.

An insurer is required to provide “medical and any other reasons” in 12 separate areas of the SABS.

The seminal LAT decision on the subject is M.B. v. Aviva (16-002325 v Aviva), but the Divisional Court and the Court of Appeal have also weighed in.

Tip: Filter by “Case Type” to find higher court decisions.

LAT Compendium Search:

1. Go to the Benefit/Issue Search

2. Set search criteria to Medical Reason

3. Filter Results by “Case Type”: Court of Appeal and Judicial Appeal/Review

Results: 5 decisions on inHEALTH’s LAT Compendium

SABS Test: Hedley v Aviva: Where reasons are required, they must be meaningful in order to permit the insured to decide whether or not to challenge the insurer’s determination. Mere “boilerplate” statements do not provide a principled rationale to which an insured can respond.

Most Databases Miss This One Powerful Feature

Q: What’s the best way to narrow down a search?

Finding the most relevant AB case isn’t always easy especially when you’re looking for key principles or a fact pattern that closely matches your own. That’s where inHEALTH comes in.

Your initial search may return dozens, sometimes hundreds of cases. So how do you cut through the noise?

inHEALTH offers what no other database does: intelligent, intuitive Search Filters—what we call ‘Smart Filters’.

They don’t just narrow your results—they guide you to the most relevant cases faster.

A: After your initial search, Smart Filters appear on the left side of your screen—ready to help you zero in on the most relevant AB cases

Twelve categories are automatically populated to narrow your results quickly and precisely. These include:

-

Issues

-

Favour of Decision

-

Hearing Type

-

Insurance Company

-

Applicant Counsel

-

Applicant Firm

-

Respondent Counsel

-

Respondent Firm

-

Adjudicator

-

Case Type

-

Referenced Cases/Legislation

-

Release Date

Pro Tip: Results in Smart Filters are populated in relation to your initial search

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced search

2. Select Primary Criteria: Issues/Benefit in Dispute and IRB-Post 104

3. Select Secondary Criteria: Issues/Benefit in Dispute and Reasonably Necessary Test (S.44)

4. Results: 5 decisions on inHEALTH’s LAT Compendium.

IRB Post Age 65 Adjustments

Q: My Client will soon turn 65 and his CPP-D will be converted to Old Age Security. Will this affect his IRBs?

Because the client is already receiving IRBs at the time he turns 65, the s.8(1) “ramp down” adjustment applies.

His new IRB amount is found by:

-

Taking the amount of IRBs he was entitled to just before he turned 65, without any s.7(3) deductions for post-accident income

-

Multiply that amount by 0.02 and the number of years he was entitled to IRBs (capped at 35)

As Old Age Security would be received after the person turned 65, this would not be included in the calculation.

Keep in mind: if the person turned 65 less than two years after the accident, this adjustment only happens at the two-year mark.

Tip: Find cases that interpret the relevant section and provide practical calculation examples!

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced search

2. Select Primary Criteria and “Referenced Cases/Legislation”: SABS: S.8(1)

OR Select Primary Criteria and Issues/Benefit in Dispute: IRB-Ramp Down

3. Results: 8 decisions on inHEALTH’s LAT Compendium.

20-013374 v Certas: Pursuant to s.8(1) of the Schedule, the second anniversary of the date she was entitled to IRBs was April 20, 2021. The Adjudicator accepted the Respondent’s calculations for the quantum payable after April 20, 2021. It correctly applied the formula of C x 0.02 x D as follows: $265.00 (weekly amount of IRB the Applicant was entitled to receive immediately before age 65) x 0.02 x 2 (number of years she qualified for the IRB before age 65) = $10.60 per week.

19-009201 v Certas: The Applicant turned 65 on March 18, 2019, while he was receiving IRB payments. Vice-Chair Boyce found that the Respondent correctly applied the s. 8(1) formula of C x 0.02 x D which resulted in an IRB of $16 per week. The Respondent allowed $400 (the pre-age 65 weekly amount) x 0.02 x 2 (the number of years the Applicant qualified for IRB before turning 65). Vice-Chair Boyce found that the Respondent’s use of 2 in place of “D” in its calculation was appropriate, as 2 is less than 35 and was the later of the applicant’s 65th birthday and the second anniversary of his IRB entitlement. The Applicant is not entitled to a different “ramp down” IRB quantum, either retroactively or ongoing, as it is not supported by the Schedule.

18-008232 v Aviva: While the Applicant turned 65 years old on October 22, 2017, he submitted that the ramp down adjustment does not apply because he was not receiving an IRB immediately before his 65th birthday. Adjudicator Neilson agreed with the Respondent that the term “receiving an IRB” under s.8(1) of the Schedule means “entitled to receive an IRB” regardless of when the Applicant begins to receive payment. In this case, the Applicant was first entitled to receive IRB on December 17, 2016, which means the second anniversary was December 17, 2018. The Applicant was not receiving any collateral benefits by December 16, 2018, therefore his IRB payable is $267.18 per week from November 1, 2017 to December 16, 2018, amounting to $15,549.88. From December 17, 2018 onwards, the Applicant is entitled to $10.69 per week after the ramp down adjustment.

OR

Narrow Search Results By Doctor

Q: I was able to search for Issue: CAT-WPI Determination, but how do I narrow it to only results involving Dr. Basile?

That’s an easy one!

When looking for a doctor, combine inHEALTH LAT Compendium’s Keyword Search with Filters

-

Enter the doctor’s last name in the keyword search

-

Use the filters on the left hand side to narrow down your results.

Did you know

The keyword search can also be used to search assessors, clinics and case numbers.

Pro Tip: Just search by the doctor’s last name

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword search

2. Enter: Basile

3. Filter by “Issues”: CAT-WPI Determination

4. Results: 9 decisions on inHEALTH’s LAT Compendium.

Psych Pre-Screen Interview Justifies Psych-Assessment?

Q: Are there decisions that support a pre-screen psychological interview as sufficient evidence for approval of a psychological assessment?

S.18(5) sets out that medical and rehabilitation benefits include “all fees and expenses for conducting assessments and examinations and preparing reports in connection with any benefits or payment to or for an insured person”. This includes psychological assessments. The test for finding an assessment reasonable and necessary has generally been treated by the Tribunal as less stringent than the test for entitlement to a Treatment Plan as an assessment simply must be justified based on the reasonableness and necessity of further exploration. In 17-006929 v. Allstate the Tribunal held that:

[75] In my view, the request for an assessment is to show that there is a reasonable possibility that the applicant has the condition that the assessment is proposing to investigate. The applicant does not need to show or prove that he has the condition in order for an assessment to be deemed to be reasonable and necessary. The purpose of the assessment would be to prove whether the applicant does or does not have the impairment.

Tip: Combine keywords with filters to quickly find relevant decisions.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword search and enter: pre-screen

2. Filter by “Issues”: Assessment-Psych

3. Filter by “Favour of Decision”: For Applicant and Split

Results: 40 decisions on inHEALTH’s LAT Compendium

17-006460 v Scottish & York: Adjudicator Victor determined that the Applicant’s psychological symptoms were consistently reported in his pre-screening and on both IEs which included anger, frustration, overwhelming stress due to inability to work, low/sad mood, lack of energy, poor sleep, anxiety, flashbacks and problems with memory and attention. While a psychological diagnosis is not necessary in determining entitlement, Adjudicator Victor noted “what is necessary is that the applicant was exhibiting psychological symptoms related to the MVA and that these issues were affecting his life, which I find they were”. In light of the consistent symptoms reported in the pre-screen and first IE, the psychological assessment in the amount of $2,258.88 was found to be reasonable and necessary.

21-004212 v Aviva: The Applicant claimed entitlement to a Treatment Plan for psychological assessment in the amount of $2,486. She submitted that her chronic pain and psychological symptoms should be investigated, relying on the records and pre-screen interview by psychologist Dr. Waxer that determined her need for a full psychological assessment. In addition, a report by Dr. Wilderman indicated that she met the criteria for chronic pain set by the AMA Guides. Adjudicator Fogarty agreed with the Applicant and found that her condition was in favor of further investigation into how her chronic pain affected her psychological state.

17-000851 v Aviva: Despite finding that the psychological assessment by Dr. Levinson dated February 2015 was reasonable and necessary based on the pre-screening, it was not payable as the Applicant’s failure to incur the expense was not due to the Respondent unreasonably withholding or delaying payments but rather his refusal to attend the IEs.

18-003305 v Guarantee Company of North America: Lastly, the Applicant relied on the CNRs of Dr. Zaremba’s, the in-home report of Ms. Granovsky, an OCF-2 and the psychological pre-screen report by Dr. Aghamohseni in support of the claim for a psychological assessment. Adjudicator Norris found the Respondent’s evidence outweighed those of the Applicant. Dr. Murray’s psychological IE noted the Applicant had symptoms of anxiety but they were minor. Dr. Murrary also conducted validity testing and found the Applicant was exaggerating symptoms. Thus, the Applicant was not entitled to the psychological assessment.

18-006820 v Aviva: Adjudicator Lake assigned more weight on Dr. Aghamohseni’s pre-screen report included in the OCF-18 as it is clear that he was aware of Applicant’s mental health history and her diagnosis of schizophrenia, which warrants a more comprehensive assessment. On the contrary, Dr. Sivasubramanian’s August 2018 IE report was assigned little weight as it was done after the submission of the plan. In any event, his opinion was given as to the necessity of psychological treatment rather than the reasonableness and necessity of psychological assessment. Thus, the Applicant is entitled to the psychological assessment in the amount of $2,197.29.

Post 104 IRB & Vocational Evaluations

Q: What factors does the Tribunal weigh when assessing vocational evaluations involving Post-104 IRB claims?

Section 6(2)(b) of the Schedule lays out the eligibility criteria for an IRB after the first 104 weeks of disability. Vocational evaluations are used to assist the parties and the Tribunal in determining if an Applicant has, as a result of the accident, a complete inability to engage in any employment or self-employment for which he is reasonably suited by education, training, or experience.

Tip: You don’t need to use quotation marks for the LAT Compendium Keyword search.

LAT Compendium Search

- Keyword Search: Go to Keyword Search

- Type vocational evaluation *(note: search vocational assessment for more results.)

- Filter Results by IRB-Post 104

Results: 14 decisions on inHEALTH’s LAT Compendium

16-000874 v Certas: The jobs identified by the Vocational Evaluation Report were entry-level minimum wage jobs which were not reasonably comparable to the Applicant’s previous employment in terms of wages, status or the work itself. Further, her Labour Market Analysis indicated relatively high unemployment rates for these jobs.

17-000889 v Travelers: The Adjudicator found Mr. Bachmann’s report to be “a thorough assessment of the applicant’s vocational history and functional limitations” and provided “an in-depth analysis supporting his conclusion that the applicant is unable to engage in any employment for which he is reasonably suited by education, training or experience”.

18-008937 v Certas: The Adjudicator found that the vocational evaluation report noted the Applicant’s lack of formal education, her lack of English skills and computer skills. It also included a transferable skills analysis and a comprehensive skills profile along with four suitable employment alternatives with compensation ranges for each, which were in line with her pre-accident income.

20-000143 v TD Insurance: The Vice-Chair did not find Ms. Billet’s IE vocational evaluation report or transferable skills analysis report appreciated how the Applicant’s psychological symptoms would affect her ability, mentally and physically, to engage in the types of occupations it proposed in light of her complaints about her inability to handle a rush and the anxiety that leads to her getting flustered and breaking down.

20-010511 v Wawanesa: The Panel placed less weight on the IE report of Vocational Evaluation Specialist Mr. Zervas because he was unable to identify any openings for the suggested roles in Northern Ontario, where the Applicant lived.

21-001592 v Intact: The Adjudicator accepted the findings of the Vocational Evaluation Report that the Applicant’s employability can only be accurately assessed when all factors (skill sets, chronic pain status, physical and cognitive limitations, emotionality, plus age) are considered.

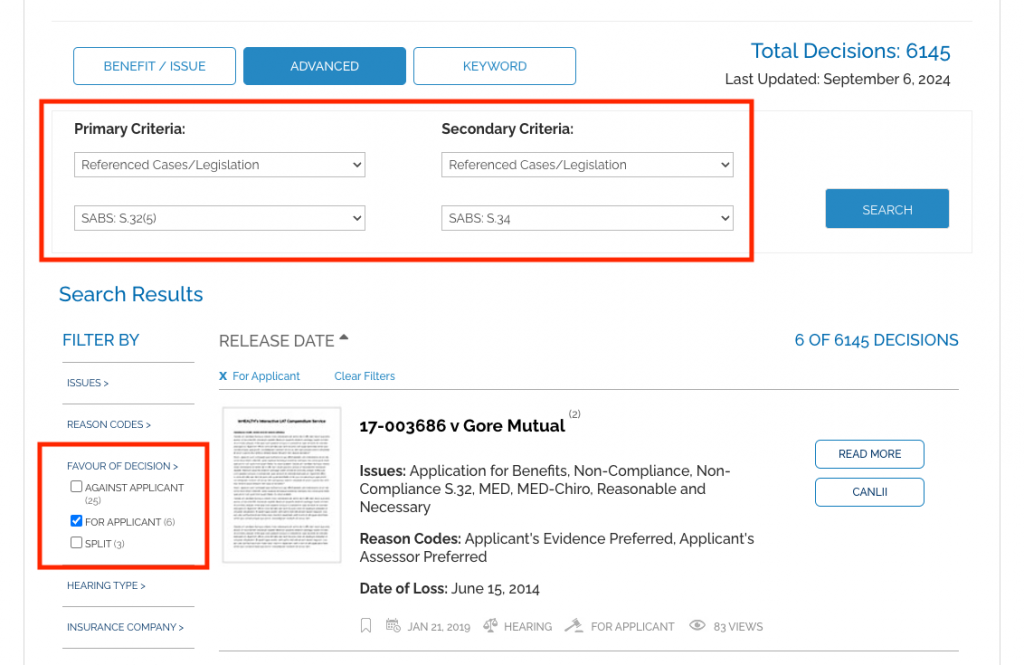

Reasonable Explanation

Q: When non-compliant with the 30 day time limit for submitting an OCF 1 Application for Accident Benefits as required under section 32(5) of the SABS, what constitutes a “reasonable explanation” under section 34?

Tip: Use Primary and Secondary searches to narrow your search results to find an answer.

LAT Compendium Search:

1. Go to Advanced Search

2. Set Primary Criteria to “Referenced Cases/Legislation”: SABS: S.32.5

3. Set Secondary Criteria to “Referenced Cases/Legislation”: SABS: S.34

4. Filter Results by “Favour of Decision”: For Applicant

Results: 6 decisions on inHEALTH’s LAT Compendium

Most Recent Decision: 23-014535 v Sonnet Insurance (August 7, 2024) The Tribunal found that, consistent with his examination under oath, the Applicant had limited familiarity with the accident benefits process, had limited English skills and was relying on his representative for his claim.

SABS Test: The guiding principles to what is a “reasonable explanation” are set out in Horvath v Allstate

Repaying ALL the IRBs Paid

Q: If an insured person being paid IRBs wilfully misrepresents his return to work, can he be compelled to repay all IRBs received or just those paid since his return to work?

Section 52(1)(a) of the Schedule provides for an insurer to be repaid benefits paid as a result of wilful misrepresentation or fraud. Our LAT Compendium search allowed us to quickly find that when an insured misrepresents their return to work, the insurer is entitled to repayment from the time they go back to work. However, if the insured does not demonstrate when they went back to work, the entire amount of IRBs paid may be ordered.

Tip: Use Primary and Secondary Criteria in our advanced search to find decisions containing both issues.

Talk to your personal support team on Live Chat. We provide answers

- Go to Advanced Search

- Select Primary Criteria “Issues”: Misrepresentation

- Select Secondary Criteria “Issues”: IRB-Repayment

- Filter results by “Favour of Decision”: For Applicant (in repayment cases, the insurer is often the Applicant.)

Results: 39 decisions on inHEALTH’s LAT Compendium

19-010729 v Unifund: The insurer was entitled to an IRB repayment of $4,431.14 due to the Respondent’s wilful misrepresentation of his return-to-work status for purposes of claiming IRB. He was ordered to refund IRBs starting from when he went back to work.

19-009392 v Aviva: The insurer was entitled to an IRB repayment of $5600. The Tribunal found that the insured failed to notify the insurer that he had returned to full-time duties as required by the Schedule and continued to collect payment of IRBs while no longer eligible, which amounts to a wilful misrepresentation. He was ordered to refund IRBs starting from when he went back to work.

20-000592 v Aviva: The insurer was entitled to IRB repayment of $36,456.00 for the period of May 12, 2017 to February 7, 2019 on the basis that the insured willfully misrepresented her return-to-work status. The Tribunal was unable to determine the applicable period of repayment as it did not accept the insured’s EUO evidence that she only returned to work in September 2018 given her inconsistent and perjurious testimony. Therefore, it found that the entire amount of IRBs paid was repayable.

19-008573 v Travelers: The Tribunal found that the insurer was entitled to a repayment of IRBs in the amount of $25,771.43 plus interest due to the Respondent’s wilful misrepresentation of her employment status. While there was a letter in evidence suggesting the insured went back to work in August 2016, the Tribunal ordered all IRBs paid going back to July 2016, In the absence of any submissions by the insured.

20-014898 v Certas: The insurer was entitled to repayment of $85,181.38, which was the full amount of IRBs paid, due to the insured’s willful misrepresentation and his failure to disclose records verifying his post-accident employment.

Rescheduling IE's

Q: What discretion does the Tribunal have to stay a proceeding and require insurers to allow an Applicant to attend a rescheduled IE?

S.55(2) of the Schedule permits the Tribunal to exercise its discretion to permit an Applicant to proceed with their claim before the Tribunal despite not complying with an IE pursuant to s.44. In these cases the Tribunal can stay the proceeding to allow the Applicant to attend, and may impose terms and conditions pursuant to s.55(3).

Tip: Filter search results on inHEALTH’s LAT Compendium by “Referenced Cases/Legislation” to zero-in on SABS section specific decisions.

LAT Compendium Search

- Go to Issue/Benefit in Dispute

- Select Non-Compliance S.44-Reschedule

- Filter Results by “Referenced Cases/Legislation”: SABS: S.55(2)

Results: 8 decisions on inHEALTH’s LAT Compendium

|

17-007683 v Aviva: Adjudicator Ferguson found that the Applicant’s explanations for failing to attend the IE were reasonable, and that the Respondent never disputed that such reasons were unreasonable or untruthful. The Respondent’s position “ignored the two cancellations for which written notice was provided. These events speak to the Applicant’s intention to comply with the Schedule and against any wilful non-compliance on her part. Pursuant to s.55(2) and (3) the Applicant must attend IEs required by the Respondent to assess IRBs and the Respondent must provide new IE dates within 35 days of the decision, and clearly set out the reasons for the rescheduled IEs. 19-001881 v Co-operators: The Tribunal found that the Applicant provided a reasonable explanation for her non-attendance at an IE as she did not receive notice of the IE from the Respondent or her counsel, and would have attended otherwise. Despite any prejudice to the Respondent the Tribunal found that barring the Applicant would be disproportionate, therefore she is allowed to proceed with her appeal once she attends the IE within 35 business days of the release of the decision. 18-011431 v Aviva: Given that the Applicant provided no reasonable explanation for her non-compliance with the Respondent’s IE request, Adjudicator Maleki-Yazdi declined to exercise the discretion afforded by s. 55(2). 20-013261 v Wawanesa: Adjudicator Watt found it would be unfair now under s.55(2) and (3) to grant permission for the Applicant to attend an examination, even with terms and conditions as The Respondent would be prejudiced now to have to try to assess any physical, psychological and vocational issues that might relate to IRB eligibility during the relevant time frame. 21-005342 v Intact: The Applicant’s entitlement to certain benefits hinges on a determination of whether he is catastrophically impaired, and fairness provides that, should he be, he has access to them as soon as possible. A dismissal at this stage would cause unnecessary delay by forcing him to reapply. It may be that after the completion of the IE a substantive hearing is not necessary. If it is necessary, a stay of proceedings allows the parties to contact the Tribunal to request a case conference to schedule a hearing, without unnecessary delay. |

Research Reports That Work as Hard as You Do

Q: Can you do the research for me?

Yes! We write research reports that get you to the relevant points, fast, without the time investment.

With over 7,000 decisions summarized and indexed, we know stuff.

In case you missed the intro:

Brett Carr, inHEALTH’s Legal Research Associate, brings his personal injury experience to his role in crafting inHEALTH’s Outcome Analysis Reports (OARs): our research reports complete with search results, For and Against cases and relevant excerpts from inHEALTH’s case summaries and CanLII paras.

The OAR now features a streamlined ‘Overview’ section that includes:

-

Key findings contextualized to your case

-

Relevant SABS provisions and legal tests

-

Likely questions and arguments that may be raised

-

A heads-up on potential problem areas

Useful when it counts, at any stage of your case.

Get an OAR: your shortcut to in-depth caselaw research with no time wasted!

Root Words for Keyword Searches

Q. I’m looking for cases where attendant care has been allowed for a suicide watch? I tried the Benefit/Issues search under Attendant Care and it returned too many cases. How do I pinpoint my search?

inHEALTH’s keyword search allows you to combine keyword results with our array of search filters, allowing you to quickly zero in on the best cases for your issue. When there are multiple ways that a word can be used, such as suicide and suicidal you can truncate the word to its root in order to catch all the relevant decisions. For example use suicid.

Tip: Truncate your keywords to capture words that share the root.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Keyword Search

2. Enter: suicid

3. Filter by “Issues”: Attendant Care

S.44 Insurer Exams - How Often is Too Often?

Q: I’m looking for cases that deal with the frequency upon which an insurer can examine the insured on the same benefit.

Section 44, “Examination Required by Insurer” allows an insurer, “not more often than is reasonably necessary “ to have an insured person examined. The LAT has fleshed out a Reasonably Necessary test in two key decisions: Al-Shimasawi v. Wawanesa and 16-003144 v. CUMIS General Insurance.

Tip: Did you know that inHEALTH has developed a large list of ‘issue filters’ based on our extensive knowledge of the SABS? For this question, we were able to narrow the search by starting with the ‘Reasonably Necessary Test (S.44)’ issue. Alternatively, we could do a ‘Referenced Cases’ search for the two key cases: Al-Shimasawi v. Wawanesa and 16-003144 v. CUMIS.

Talk to your personal support team on Live Chat. We provide answers

- Go to Benefit/Issue Search

- Select Issues/Benefit in Dispute: Reasonably Necessary Test (S.44)

- Filter results by “Favour of Decision”

Results: 12 decisions on inHEALTH’s LAT Compendium

16-003144 v Cumis: In balancing these rights, a number of factors can be considered. There must be a reasonable nexus between the type of examination requested and the claimed impairments. The purpose and timing of the request should be considered. Insurer’s examinations should be for the purpose of adjusting the claim, not solely to bolster a case for litigation. Some other factors to consider include the number and nature of previous and requested examinations, whether there are new conditions that need to be evaluated, and whether either side will be prejudiced by the examination or non-compliance with a request for an examination. If there are numerous examinations, the insurer should proceed cautiously, as all of the assessments may not be necessary. There must also be an acceptable reason for non-compliance with requests for insurer’s examination requests, such as a medical reason for non-attendance.

21-005342 v Intact: The Tribunal found it would be prejudicial to the Applicant to undergo another psychological IE following the death of the initial assessor Dr. Kiss, and that the complete file and raw psychological test data had been provided to Psychologist Dr. L. Davidson. In Dr. Davidson’s opinion, which the Tribunal found reasonable, Dr. Kiss had administered a reasonable battery of tests, and there was sufficient testing for a psychological report.

19-009160 v MVACF: Considering the six factors outlined in the FSCO case of Al-Shimasawi v. Wawanesa, Vice Chair McGee found there was no new medical information to prompt the need for subsequent IEs. The prejudice the Respondent asserted it suffered as a result of the Applicant’s non-attendance was primarily a consequence of its own errors and missteps in adjusting the claim.

Too Many Search Results?

Q. I tried to search “Issues/Benefit in Dispute: Reasonable and Necessary” and got 2000 cases returned. This is unmanageable for my needs. Please help me!

The good thing about having access to a dedicated AB database and SABS-specific search indexing system is that you should be able to find exactly what you are looking for, right?

Occasionally, though, when your search terms are too broad you could end up with longer than necessary load times and get back too many cases. This week’s tip offers a solution.

If you are having trouble coming up with a narrow enough search, our Live Chat search experts can help! We will ask a series of questions to make sure we understand the specific fact pattern, legal issue or SABS interpretation involved to target the most optimal search.

Tip: Describe your situation to a Live Chat search expert so that we can help you find the right cases!

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Click on “Let’s Talk” in the bottom right corner.

2. Describe what you are searching for or the problem you want solved.

Unreported 'Cash' Income Included In IRB Calculation?

Q. I am looking for case law that supports that cash income must be declared to CRA in order to be considered gross employment income.

Under Part II of the Schedule, Income Replacement Benefits have their own sub-set of terms and definitions.

4 (1) “Gross Employment Income” is defined as

“gross employment income” means salary, wages and other remuneration from employment, including fees and other remuneration for holding office, and any benefits received under the Employment Insurance Act (Canada), but excludes any retiring allowance within the meaning of the Income Tax Act (Canada) and severance pay that may be received; (“revenu brut d’emploi”)

4 (5) Requirement to report income.

If, under the Income Tax Act (Canada) or legislation of another jurisdiction that imposes a tax calculated by reference to income, a person is required to report the amount of his or her income, the person’s income before an accident shall be determined for the purposes of this Part without reference to any income the person has failed to report contrary to that Act or legislation. O. Reg. 34/10, s. 4 (5).

Tip: Calculating the ‘Amount of Weekly Benefit’ described under section 7 of Income Replacement Benefits must be read together with section 4 “Interpretation” of the Schedule where certain terms and interpretations are further defined.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced search

2. Select Primary Criteria: “Referenced Cases/Legislation” and SABS: S.4(5)

3. Filter by “Issues”: IRB-Quantum

Results: 15 decisions on inHEALTH’s LAT Compendium

19-005907 v Echelon: Although the Respondent is required to pay IRBs from April 25, 2019, to February 24, 2020, the Tribunal found that the Applicant’s 2017 tax return did not confirm what portion of his earnings were made during the 52 weeks prior to the accident. He did not file a tax return in 2018, and there was evidence that he worked in 2019. The Tribunal found that any income earned in 2018 cannot be included in the calculation of IRBs pursuant to s.4(5) of the Schedule.

20-000630 v Certas: The Applicant was unemployed in the three months prior to the accident. The Respondent calculated his IRBs based on his income tax returns from 2012-2017. The Applicant’s employment file from his previous employer indicated that he earned a salary of 24,500 yuan from October 2010 to October 2016. His paystubs from May to October 2016 indicate that he was paid in the range of 24,915 to 25,366 yuan a month. His tax returns from 2015, 2016 and 2017, showed his reported income was $3,500, $5,800 and $1, respectively. Vice-Chair Boyce agreed with the Respondent that when s.4(3) of the Schedule is read in conjunction with s.4(5) and s.4(6), insurers are directed to rely on the amounts reported to and accepted by the CRA when calculating income. Any income not reported to the CRA cannot form part of the IRB calculation. The Applicant did not provide reply submissions to rebut this position or an alternative IRB quantum calculation. The Vice-Chair found that the Respondent properly calculated the IRB.

What Cause is ‘Dominant’ in an Accident?

Q: There are many circumstances where the use or operation of an automobile can be considered an accident. What is the court’s interpretation of ‘intervening act’ when considering whether the facts meet the ‘definition of accident’?

As outlined in Economical v. Caughy, the causation test requires the adjudicator to determine if these “ordinary and well-known activities” were the direct cause of the Applicant’s impairments by focusing on the following considerations:

- The “but for” consideration;

- The intervening act consideration, which may serve to break the chain of causation where some other intervening events cannot be said to be part of the ordinary course of use or operation of the vehicle; and,

- When faced with a number of possible causes, the “dominant feature” consideration focuses on whether the ordinary and well-known activity is what most directly caused the injury.

Tip: Filter by “Judicial Appeal/Review” to find Divisional Court decisions.

LAT Compendium Search

- Go to Advanced Search

- Primary Search by “Issues/Benefit In Dispute”: Causation-Intervening Cause

- Secondary Search by “Issues/Benefit In Dispute”: Definition-Accident

- Filter Results under Case Type: Judicial Appeal/Review

Results: 7 decisions on inHEALTH’s LAT Compendium

Porter v Aviva: “Legal entitlement to accident benefits requires not just that the use or operation of a car be a cause of the injuries, but that it be a direct cause.” In this case, the dominant factor that caused Ms. Porter’s injuries was the icy, snow-covered driveway, and the use or operation of the Lyft car was “at best ancillary”, but not a direct cause of the injuries.

Sajid v Certas: The Court of Appeal noted in Greenhalgh v. ING Halifax, the “but for” test can act as a useful screen,” but in some cases, “the presence of intervening causes may serve to break the link of causation where the intervening events cannot be said to be part of the ordinary course of use or operation of the automobile.”

Jiang v Co-operators: In applying the “intervening cause” test, Adjudicator Kaur erred by ignoring there were two phases to the incident: injuries allegedly caused by an assault and injuries allegedly arising from the subsequent loss of control of the vehicle. Adjudicator Kaur failed to give reasons for why the road accident was also not a direct cause of the injuries.

Davis v Aviva: The black ice the Applicant slipped on was fortuitous, but not an intervening cause or event. The Applicant had the electronic key fob in her hand to open and enter her car, which was a part of the use of a motor vehicle. She was so close to completing that entry that her leg came to rest under the front wheel on the driver’s side. “Referring to the reasoning in Seung, the presence of the key fob was a fact that supported the finding that the use of the car was the direct cause of her fall, not the ice beneath her feet”.

What’s in a Name?

Q. I want to see my LAT decisions, associated issues, and results. How can I find this information?

Counsel Name Search

Counsel name searches are found by using inHEALTH LAT Compendium’s Advanced Search and selecting the drop-down criteria for Applicant Counsel and Respondent Counsel.

Filters

Once your results are returned the “filters” found on the left side navigation bar are populated with all the associated results for those decisions.

Issues

Have a look at the ‘Issues’ tab to see the list of associated issues raised and the number of decisions with those issues.

Favour of Decision

Filter further to “Favour of Decision’ for the win/loss/split results.

Tip: Unlock all search possibilities—explore the Advanced Search drop-down, including Applicant/Respondent Counsel options.

Talk to your personal support team on Live Chat. We provide answers

Login to inHEALTH’s LAT Compendium:

1. Go to Advanced Search

2. Under Primary Criteria Select: “Applicant Counsel” or “Respondent Counsel”

3. Filter by “Issues” & “Favor of Decision”: Go to left side navigation bar to see associated ‘Issues’ and ‘Favor of Decision’

Let inHEALTH’s Experience Work for You

With 6,000+ LAT decisions reviewed, indexed, summarized – We know stuff.

Our Team Is Here To Help!

1

Select your

service

2

Ask your question

3

Our Team provides answers

Get Started here