Volume. 7 Issue. 8 – March 8, 2023

Read this week’s edition to appreciate the implications when a Personal Support Worker (PSW) provided Attendant Care (ACB) to an injured party, while simultaneously presenting herself as disabled collecting Income Replacement Benefits (IRB) and requiring ACB herself.

LAT Update – What Difference Did A Year Make?

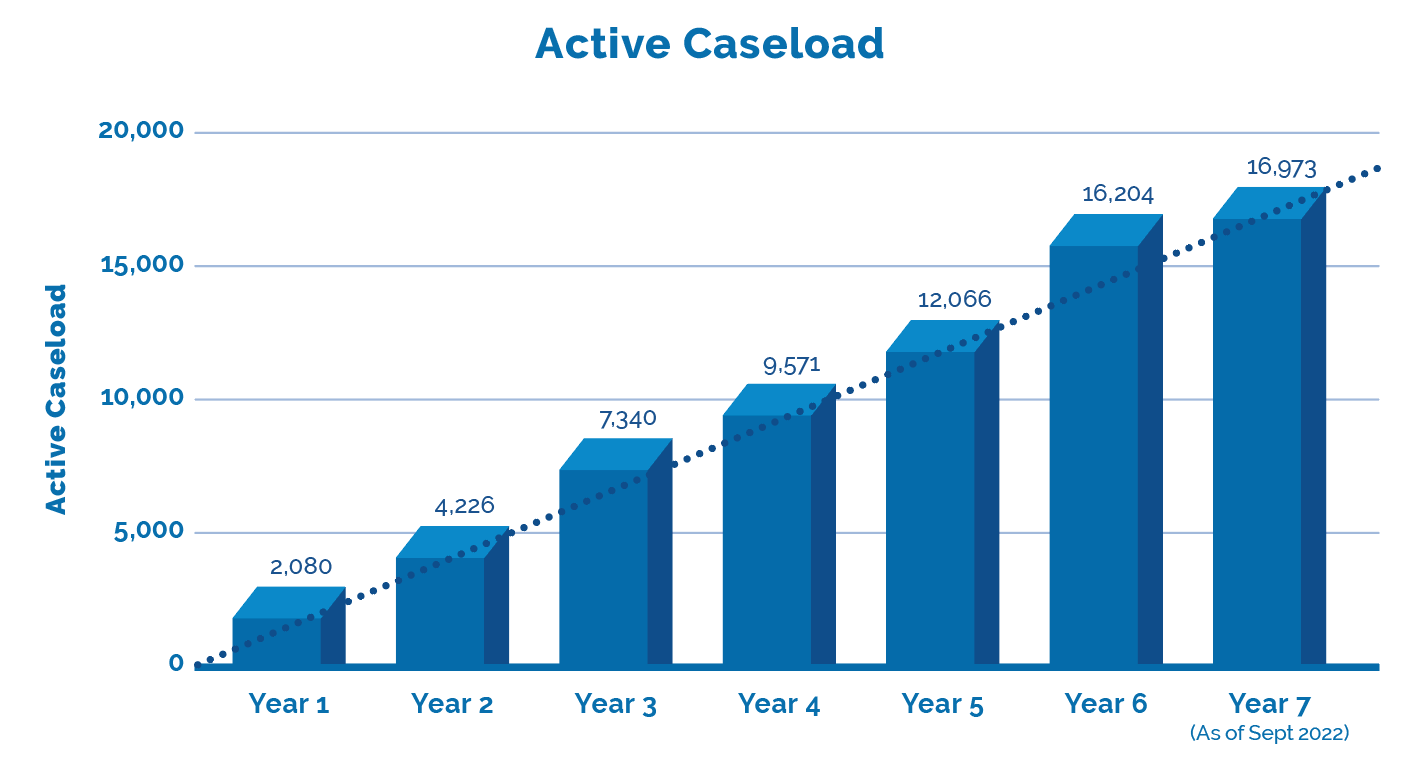

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

Providing and Receiving ACB Simultaneously Costly for Applicant

Caught In a Tangled Web – Injured in a September 2016 MVA, the Applicant Ravilotchanan, in 21-003421 v Allstate, received a total of $41,597 in benefits from Allstate. This consisted of $23,600 for IRB, $5971 ACB and $12,026 in medical benefits. All the while simultaneously, and not coincidentally, Ravilotchanan was alleged to have been providing ACB to an injured party, by way of an accident benefit claim with Wawanesa.

Wawanesa provided a statutory declaration executed by Ravilotchanan, confirming that she had been providing ACB to a Wawanesa customer through a clinic called North Agincourt Healthcare. As a result of this information Allstate filed an application with the Tribunal, seeking repayment by Ravilotchanan of all benefits they had paid.

The Tribunal noted that Ravilotchanan had in fact signed a document, essentially admitting to all of the activities that Allstate was relying upon to justify repayment. However, before the Tribunal, Ravilotchanan testified that despite affirming the truth of said document, she now denied ever having received payments, nor was she involved, for any services alleged to Wawanesa’s customer. The Tribunal found that the evidence of Ravilotchanan “boils down to an admission that she lied in a formal declaration and that admissions made on her behalf are not true, but I should believe her now, my assessment of the respondent’s credibility is key. I do not believe her now.”

Concurrently, Wawanesa had brought suit against North Agincourt, seeking in excess of $134,000 in ACB that they had billed for services in providing ACB for their customer, that they alleged had never in fact been provided.

Despite seemingly being intrinsically involved in preparing the documents for ACB initially accepted by Wawanesa, Ravilotchanan changed course, suggesting now that she was not involved in the apparently fraudulent documentation, and had “received only approximately $5000 in fees for the patient”. Ultimately, the litigation ended in June 2022, with North Agincourt paying Wawanesa the sum of $45,000 to resolve the matter.

At the LAT hearing, Ravilotchanan’s evidence “boils down to the proposition that she was duped by Umesh Ponnampalam”, proprietor of North Agincourt. She described a couple of instances wherein she was taken by Ponnampalam to different lawyers, one being to sign the statutory declaration, as well as numerous timesheets, although she denies that it was her signature on some. The Tribunal was not prepared to accept that Ravilotchanan would have signed the declaration as well as approximately 18 timesheets without reading them. The second instance involved her signing documentation required in order to finalize the resolution of the litigation with Wawanesa and North Agincourt.

Ultimately, the Tribunal found that Ravilotchanan’s “version of events varies to suit the circumstances. I have no confidence in the truth of any of the evidence she gave at the hearing. Rather, in my view, the evidence discloses that she worked with North Agincourt during the time when she was receiving an income replacement benefit from Allstate. The extent of that work is not clear. It seems that she and North Agincourt entered into a scheme to get money from Wawanesa, but that scheme would not be successful without a kernel of truth, that is, that the respondent did provide some services to T.R.”

Further, the Tribunal was not prepared to accept her evidence as to the bahaviour of the two lawyers she met with Ponnampalam. This would have required the Tribunal “to accept that the two members of the bar involved in this matter abrogated their professional responsibility to her, the one asking her to sign a statutory declaration without going over the document with her and asking her if it was true, the other representing her in litigation without ever conferring with his client.”

It was determined that “the admissions she made in the pleadings in the Wawanesa litigation are closest to the truth. She did act as a subcontractor for North Agincourt in providing PSW services to T.R., she was paid, although the amount is far from clear, and these services were provided during a period when she was receiving an income replacement benefit and an attendant care benefit from Allstate.” While noting that a work return is specifically provided for in s.11 of the Schedule, with Ravilotchanan having failed to adduce any evidence to suggest her estimation of only earning $5K to be accurate, the Tribunal found that she had “wilfully or fraudulently misrepresented her ability to earn an income and failed to notify Allstate that she had returned to work. She is liable to repay the full amount of $23,600 paid to her as income replacement benefit.”

With respect to ACB, she had further managed to convince an OT of her need. She was found to have “feigned her need and did not require attendant care services but did avail herself of them when provided”, with the entirety of the ACB being payable to Allstate.

With respect to medical however, the only “taint” on entitlement to the medical benefits was the fact that Ponnampalam (of North Agincourt) was the owner of the clinic that treated Ravilotchanan. This however, was “insufficient for me to determine that a host of healthcare practitioners both at Medcore and elsewhere were somehow duped into recommending unneeded treatment for the respondent.” Therefore, Allstate was not entitled to repayment of the medical benefits.

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!