Volume. 7 Issue. 6 – February 22, 2023

This week we examine the interplay between the notice requirements to claim IRB under s.36(4) and quantum calculations under s.7(3) of the Schedule. Ultimately the Tribunal determines that the Applicant is entitled to a “nil” IRB, despite the insurer having failed to respond to the OCF3 in accordance with the Schedule. In addition, there is reference to a “return to work” denial being non-compliant, a topic the Court of Appeal considered in last week’s edition.

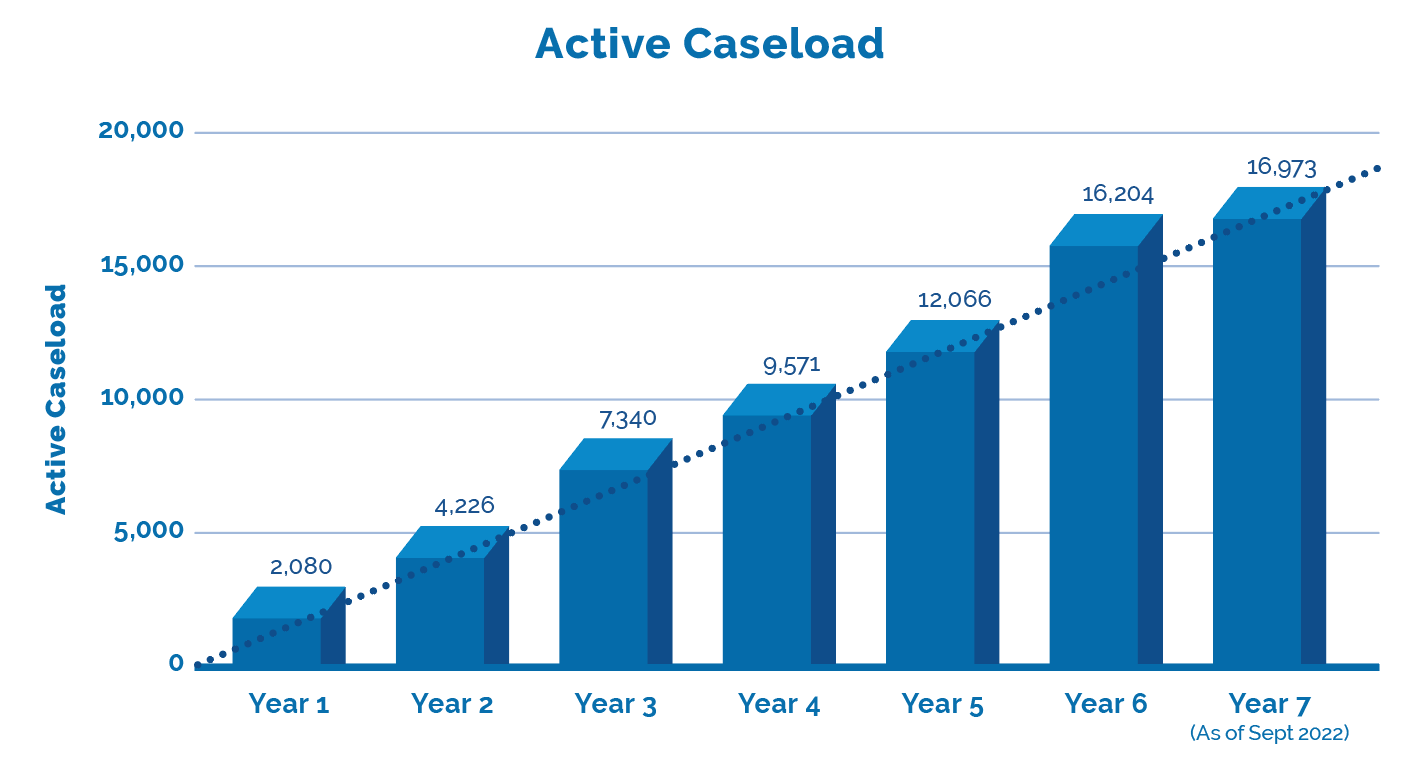

LAT Update – What Difference Did A Year Make?

The LAT released Performance Stats up to mid-year 7 which is current through to the end of September 2022. Together with the LAT’s last update we can now provide a comparison of year over year, with projections through to the end of year 7 in this annual update. What difference did a year make?

Applicant Entitled to Nil IRB Despite Respondent’s Non Compliance

IRB Rendered Nil Despite Respondent’s S.36(4) Non Compliance – The Applicant Jeffrey, injured in an April 2018 accident, sought IRB at the rate of $400 per week from August 29. 2018 to date and ongoing. The Tribunal, in 20-013979 v Travelers,, found that the entitlement sought fell into two periods.

The first being the time between the submission of the OCF-3, until Travelers responded in accordance with s.36(4), the “period of statutory entitlement”. The second being the remaining period of entitlement, in accordance with s.5(1)(1) of the Schedule.

The Tribunal, having found that Travelers had failed to deliver a timely and sufficient notice as required under the Schedule, triggered the timeline to respond to the receipt of the OCF 3. Jeffrey had submitted the required OCF-3 to Travelers as at August 31, 2018.

Travelers did for a fact respond September 7, 2018, however the Tribunal found the response did not meet the requirements under s.36(4). The response “does not give medical reasons for the denial of IRB and NEB, nor does it request additional information pursuant to section 33(1) or 33(2) of the Schedule. Instead, Travelers denies the IRB on the basis that “you have indicated that you have returned to work and were not off of work for more than 7 days, which is the deductible period”. In addition, the response “does not provide the applicant with information about her right to dispute the denial, as required by section 54.”

However, on October 2, 2018, Travelers was found to have delivered a compliant notice, thereby satisfying s.36(4), therefore ongoing entitlement would be guided by s.5(1). The Tribunal further found that a letter dated March 21, 2019, that did not include notice of the right of appeal, “does not upend the initial October 2, 2018 letter, which was compliant and did include notice of the right to appeal.” The Tribunal then confirmed that there is “no reference to the applicant having to meet the disability test under section 5(1)(1). It simply states that if the insurer fails to comply with section 36(4) it shall pay the specified benefit. In my view, if section 36(6) required the applicant to meet the section 5 disability test for an IRB, it would include reference to that test”. Therefore, Jeffrey was statutorily entitled to IRB from August 31, 2018 through to October 2, 2018.

The Tribunal next considered the OCF-2 that confirmed Jeffrey had in fact taken but one day off work, and that she was working at her pre-accident employment during the period of statutory entitlement. Accordingly, the “IRB during the period of statutory entitlement is subject to the IRB calculation provisions in section 7(3). Section 7(3) provides that the insurer can deduct 70% of gross employment from the amount to be paid for an IRB.” Therefore, during the period of statutory entitlement, the ultimate entitlement was “nil”.

Turning next to ongoing entitlement, the Tribunal took note of the fact that Jeffrey had returned to work until October 2019, at which time she was terminated without cause, with the termination letter not referencing the accident, or that she was unable to perform the essential duties of her employment. There was found to be no evidence as to an inability to perform the essential duties of the employment, the OCF-1 indicated injuries not preventing her from working, and the OCF2 confirmed but the one day off post MVA. Travelers had not sought an IE with respect to entitlement, given the extended return to work, with the Tribunal again confirming there to be no obligation to secure an IE.

Concluding, the Tribunal found that “that even if the applicant had established entitlement to an IRB pursuant to section 5(1)(1), the applicant has not provided relevant documents confirming her post-accident income”. The Tribunal drew an adverse inference from this failure to produce, with the absence of the requested financial documentation, (precluding) the respondent and the Tribunal from being able to determine quantum for the second period, even if entitlement had been established.”

Access inHEALTH’s research resources through Live Chat and receive your OAR. Get It now!